Recycly User & Setup Guides

< Back to Article ListUpdating Tax Rates in Recycly

Last updated: 15 September 2025 at 11:23:20 UTC by Russell Briggs

Tax rates occasionally need to be updated in Recycly to reflect changes in legislation or business requirements. It’s important to handle these updates correctly so that historic data remains accurate and compliant, while new transactions use the correct rate.

1. Update the rate directly on an existing tax record

- This changes the percentage on the same tax record.

- Any new transactions created after the change will use the updated rate.

- Historic transactions are not affected (they retain the old rate value as stored on the invoice).

When to use this approach:

- The tax is conceptually the same (e.g. UK VAT Standard Rate).

- You want continuity for reports (e.g. all UK VAT sales tracked under a single tax code).

- The tax name and logic do not change, only the percentage.

⚠️ Important: If the change is temporary (e.g. government short-term VAT reduction), consider creating a new tax instead (see below) so it is clear in reporting which rate applied.

2. Create a new tax rate

- This involves creating a new tax record in Recycly with the updated percentage.

- You then update products, fiscal positions, and default settings to use the new rate.

- Historic transactions remain linked to the old tax record, while new transactions use the new one.

When to use this approach:

- The change represents a new legal category (e.g. introducing a reduced VAT rate).

- The old rate should remain visible in reporting, distinct from the new rate.

- The old rate may still apply to certain goods or services, even after the change.

- You want absolute clarity in compliance audits.

Recommended Workflow

-

Check the nature of the change

- Is it a permanent percentage change for an existing tax (e.g. VAT Standard from 20% to 21%)? → Update the existing tax.

- Is it a new category, temporary change, or split between rates? → Create a new tax.

-

Apply the update in Recycly

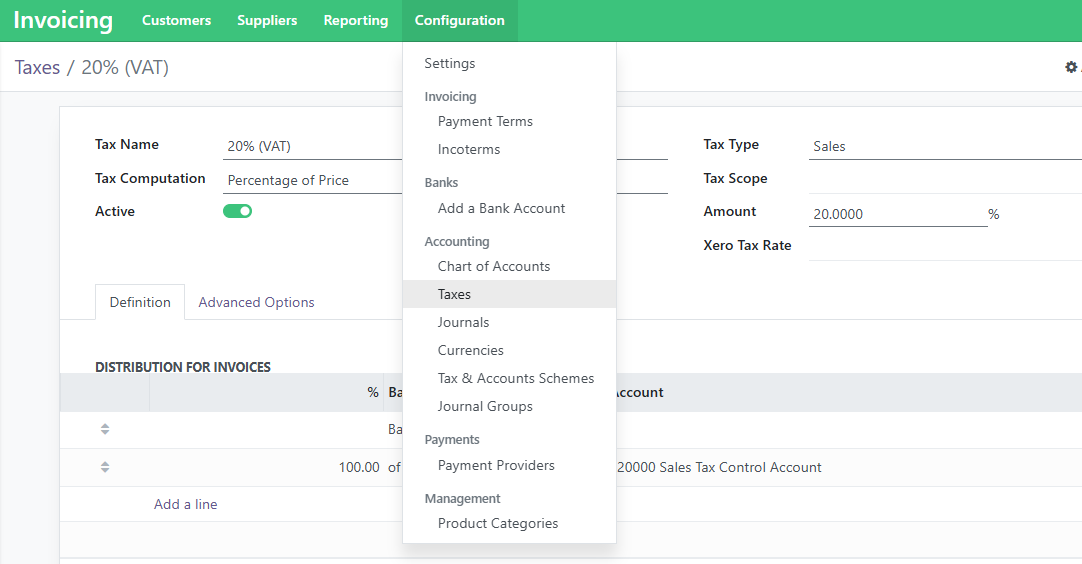

- Navigate to Accounting → Configuration → Taxes.

- Either edit the existing tax or create a new one as appropriate.

- Make sure the tax label is clear (e.g. “UK VAT Standard (20%)” vs. “UK VAT Standard (21%)”).

-

Review product and fiscal position mappings

- Ensure all relevant products and fiscal positions are linked to the correct tax.

- Update any default settings (e.g. sales journals) if a new tax is created.

-

Test with a draft invoice

- Create a draft customer invoice and vendor bill to confirm the correct tax is applied.

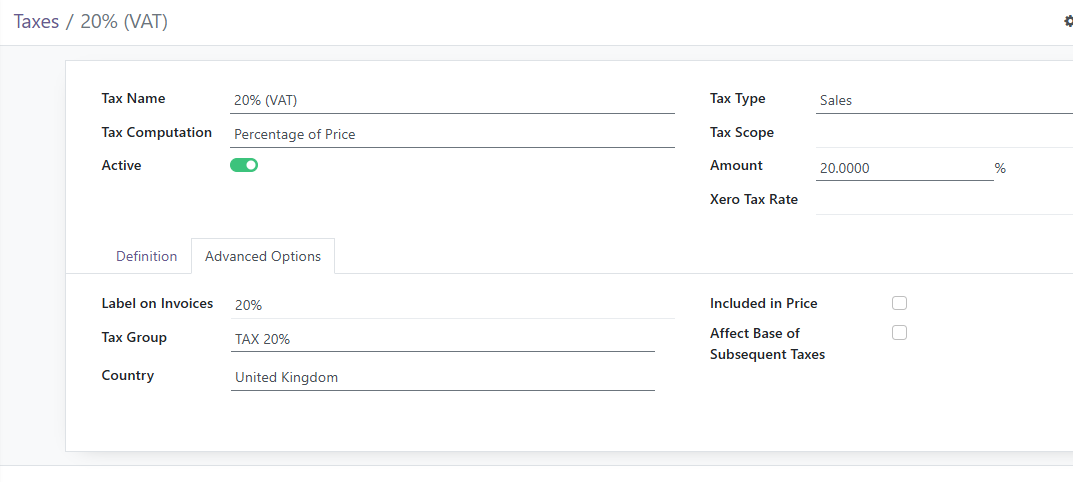

Tax Code Setup

Remember to check the "Advanced Options" tab to see all settings and descriptions